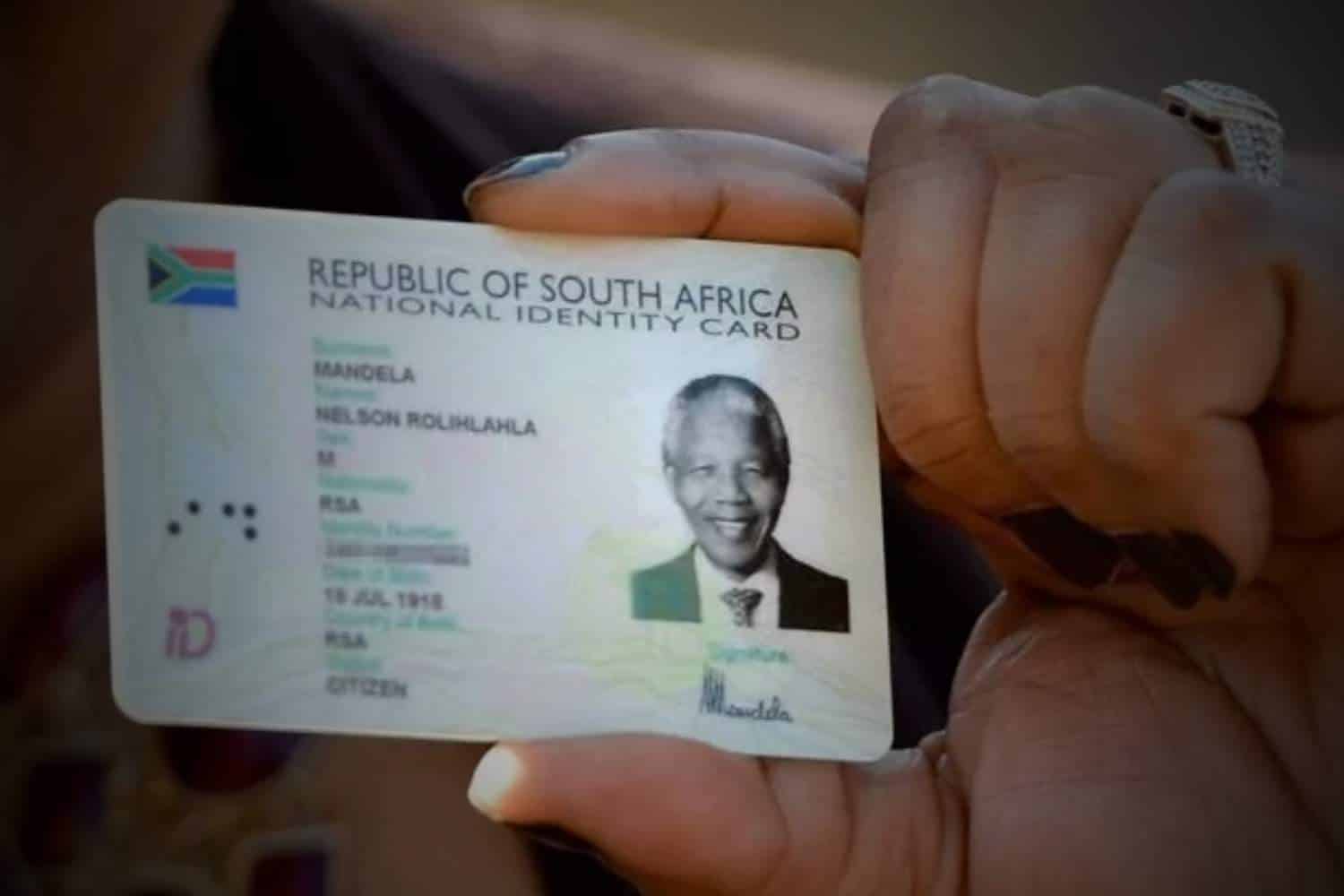

South Africa’s Department of Home Affairs (DHA) is working with local banks to make it easier for citizens to apply for smart ID cards and passports.

Banks to apply for smart ID and passports

Instead of waiting in long queues at Home Affairs offices, people will soon be able to use their own bank branches and even banking apps to handle these applications.

This project is part of a digital partnership model announced by Home Affairs Minister Leon Schreiber. He confirmed that several major banks have already joined the program, including FNB, Capitec, Standard Bank, Absa, Discovery Bank, African Bank and Nedbank.

In the past, FNB was the only bank where people could apply for a smart ID or passport.

Later, Capitec followed and announced that from October 2025, selected branches would start offering the service.

Minister Schreiber explained on social media that the goal is to make these essential services more widely available:

“ABSA and Discovery Bank have signed up to our digital partnership model expanding Smart ID and Passport services to 100s more bank branches and digital apps. They join Capitec, FNB and Standard Bank. Working together through tech to deliver dignity for all.”

He also confirmed that African Bank and Nedbank have now joined the initiative, making them the sixth and seventh banks to sign up.

How applying at a bank will work

The process at bank branches will be simple and much quicker than at traditional Home Affairs offices:

- Photo capture – If Home Affairs does not already have your ID photo, the bank will take a new one.

- Biometric checks – You will enter your ID number, and your fingerprints will be checked against the DHA database.

- Collection – After a few weeks, you will collect your new smart ID card or passport at the same branch.

- Future upgrades – Banks plan to add more options like passport renewals, application tracking on apps, and even home delivery.

When and where services will be available

Capitec has confirmed that its pilot program will begin in October 2025 at 10 branches. By early 2026, it plans to expand the service to at least 100 branches nationwide. Other banks will announce their rollout schedules in the coming months.

Currently, only about 30 bank branches across the country offer Home Affairs services. But with the participation of seven major banks, the DHA aims to expand to over 1,000 branches by 2029.

By moving these services into bank branches and digital platforms, the DHA hopes to speed up applications, reduce waiting times, and bring services closer to communities — including those in rural areas.

As Capitec CEO Graham Lee explained:

“The move is aimed at removing friction for South Africans and making essential services faster, simpler, and more accessible.”

With more banks offering the service, South Africans will soon have far more convenient ways to secure their IDs and passports.